Section 802 – Exclusions

Section 802 – Exclusions

Like the Chicago Residential Landlord and Tenant Ordinance (CRLTO), the Cook County Residential Tenant and Landlord Ordinance (CCRTLO) has a number of exclusions even if the law applies in a particular municipality. Many of the CCTLRO exclusions mirror those of the CRLTO, however, some are just a hair different while others are entirely new. Let’s take a look.

The main law is Section 42-802(A) as follows:

A. The following arrangements are not governed by this Article:

1. Transient occupancy in a hotel or motel;

2. Residence at a public or private medical, extended care facility, geriatric facility, convent, monastery, religious institution, temporary overnight shelter, transitional shelter, educational dormitory, or in a structure operated for the benefit of a social or fraternal organization;

3. Occupancy under a contract sale of a dwelling unit if the occupant is the purchaser;

4. Occupancy in a cooperative apartment by a shareholder of the cooperative;

5. Occupancy by an employee of a landlord whose occupancy is conditional upon employment in or about the premises;

6. Residential buildings in which occupancy is limited to six (6) units or less and which are owner-occupied;

7. A residential unit that is a single-family home, including a single condominium unit, provided that:

a. This is the only residential unit leased by the owner,

b. The owner or immediate family member has actually resided at the property for at least one (1) month in the 12 months prior to marketing the property,

c. The owner (not a management company) personally manages the unit, and

d. The owner is not a corporation;8. Dwelling units in hotels, motels, inns, bed-and-breakfast establishments, rooming houses, and boardinghouses, but only until such time as the dwelling unit has been occupied by a tenant for 32 or more continuous days and tenant pays a monthly rent, exclusive of any period of wrongful occupancy contrary to agreement with an owner. No landlord shall bring an action to recover possession of such unit, or avoid renting periodically, in order to avoid the application of this Article. Any willful attempt to avoid application of this Article by an owner may be punishable by criminal or civil actions.

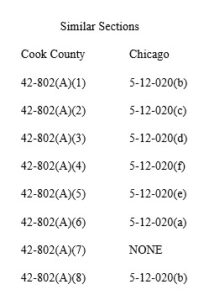

The Chicago law has six exclusions contained in Section 5-12-020. The Cook County law has eight exclusions. There is some overlap in the sections:

The exclusions

Let’s take a closer look because even though some sections are similar, they are not exactly the same.

Section 42-802(A)(1) of the CCRTLO needs to be viewed in conjunction with 42-802(A)(8). Both seem to deal with hotels and motels. Isn’t 42-802(A)(1) duplicative of 42-802(A)(8)? Excluded under (A)(1) is “Transient occupancy in a hotel or motel”. The focus here is on the nature of the occupant (transient rather than permanent) and the type of premises (hotel or motel). (A)(8) is “Dwelling units in hotels, motels, inns, bed-and-breakfast establishments, rooming houses, and boardinghouses”. The focus there is on the type of room (dwelling units) and the type of premises (hotel, motel, inn, bed-and-breakfast establishment, rooming houses and boardinghouses). (A)(8) has an exception in that once the dwelling unit has been occupied for 32 or more continuous days and rent is paid monthly,the tenancy is then governed by the act (this tracks very closely with 5-12-020(b) of the CRLTO). So, why is there a 42-802(A)(1)? I can only find a few mentions of “transient guests” in the entirety of the Cook County code. I’m guessing (just a guess – maybe I’m missing something here) that this has to do with the Cook County Hotel Accommodations Tax Ordinance.

Section 42-802(A)(2) of the CCRTLO is similar to Section 5-12-020(c) of the CRLTO. There’s a bit of different verbiage where the CCRTLO says “medical” facility while the CRLTO says hospital. The CRLTO goes into greater detail on housing arrangements between students and an educational institution. None of those distinctions really matter for good old fashioned landlords.

Section 42-802(A)(3) of the CCRTLO is similar to Section 5-12-020(d) of the CRLTO. Section 5-12-020(d) exempts units occupied by a real estate purchaser prior to the transfer of title (pre-closing possession) and units occupied by a real estate seller after the transfer of title (post-closing possession). Both pre and post-closing possession are common in the real estate world. Sometimes buyers need to move out of their current space and into the property they are about to buy just a bit early or sellers need to hold possession of the property they are selling for just a bit before they can move on to their next residence. The CCRTLO only exempts pre-closing possession when it states an exemption for “occupancy under a contract sale of a dwelling unit if the occupant is the purchaser”. Is this just an example of sloppy or bad drafting or does this section knowingly exclude post-closing possession? This is key, because buyers in real estate closing situations now have to be worried (very worried) about becoming landlords to their sellers and giving those sellers the many rights given to tenants under the CCRTLO. I predict that this one will go badly.

Section 42-802(A)(4) of the CCRTLO is similar to Section 5-12-020(f) of the CRLTO and exempts cooperative apartments. Section 42-802(A)(5) of the CCRTLO is similar to Section 5-12-020(e) of the CRLTO and exempts on site caretakers who are employees of a landlord and whose occupancy is conditional upon their employment at the property.

Section 42-802(A)(6) of the CCRTLO is similar to Section 5-12-020(a) of the CRLTO and is the one you landlords have been waiting to read about. This exemption was not in the Cook County ordinance as it was originally proposed. It is the exclusion for residential buildings in which occupancy is limited to six (6) units or less and which are owner-occupied. Remember, the key here is owner occupancy. The owner must really live there, so a 3-flat in Arlington Heights when the landlord lives in Hoffman Estatesis still governed by the ordinance.

Section 42-802(A)(7) of the CCRTLO is brand new. It provides what I am calling a “one time exclusion” for regular folks who might not have wanted to be landlords in the first place. To qualify for exclusion under this section, the residential unit must first be a single-family home or a single condominium unit. Further, the unit must be the only residential unit the owner leases out. The residential unit must have been occupied by the owner or an immediate family member for at least one month out of the twelve months prior to the marketing of the property. The owner and not a management company must personally manage the unit and the owner cannot be a corporation. I can only surmise that the Cook County Board is trying to create an exception for people who, for instance, get a job transfer to Texas and rent their only property out. I preach on these pages that landlording is for professionals and is a business. It needs to be treated like one. This one time exclusion, while merciful, forgives a new landlord for their ignorance of the law. Do note that under all circumstances, upon a renewal of a one year lease, the conditions for this exclusion will not exist. So, at best, the accidental landlord has one term to figure out that there is an ordinance that controls their Cook County rental.

New requirements

So now you know what kinds of situations are excluded from the application of the CCRTLO. There is a new requirement implemented under Section 42-802(B) of the CCRTLO that is quite different from Chicago law. The Cook County ordinance requires that landlords make it clear that a tenancy is not governed by the Cook County law. As such, if “a residence is excluded from coverage by these exclusions, the owner shall make this exclusion known to prospective tenants in marketing materials and shall prominently state the exclusion on any application materials before the owner accepts any application fees, credit check fees, or holding fees.”

Woah. So, a landlord that does not know about the existence of the ordinance does not get an exclusion just because they come under the terms of the exclusion. They have to mention it in their marketing materials and they have to “prominently state” the exclusion on any application materials and before the owner accepts any application fee, credit check fee, or holding fee So, property owners who want to take advantage of the exemption need to know about it; need to disclose it in all of their ads; and need to list it on their applications.

This is groundbreaking. This is going to trap a lot of landlords. This will definitely trap lots of those first time landlords looking for a one time exclusion. Do you know who else this is going to trap? Everyone else who is excluded. Long term care facilities, educational dorms, cooperative apartments, transitional shelters, and anywhere else that advertises and has an application and an occupancy agreement. I wonder if the Cook County board thought this one through? This is sloppy drafting, pure and simple.

Old requirements.

The Cook County ordinance makes clear in Section 42-802(C) that the anti-lockout rules contained in section 42-813 of the CCRTLO apply to all dwelling units in Cook County that are otherwise excluded by subsections (A)(3), (A)(5), (A)(6), (A)(7), and (A)(8). This is common sense. Landlords – please don’t engage in illegal lockouts.

Don’t get any funny ideas

Cook County wraps up the section on exclusions with Section 42-813(D) which provides that a “landlord shall not create a rental agreement in the form of an excluded agreement to avoid the application of this Article”. So for all of you landlords who have been concocting sly ideas of how to massage your rental situation to fit a square peg into a round hole – just forget it. The courts will be able to take a substance over form approach and pierce the exclusion if they sense that a landlord has created a form that may technically satisfy the requirements of 42-813 but which is really not, in substance, a true application of the intent of the law. This kind of provision is very dangerous for landlords who are not trying to create such a form of excluded agreement but who might have a tenant who wants to argue about it in court.

Conclusion

Much of what we are seeing from the Cook County ordinance is not new. However, it is either bad drafting or sneaking modification that lead to an ordinance that differs just slightly from the Chicago ordinance. I think we are going to see lots of trouble from the failure to exclude post-closing possession agreements from the applicability of this law and we will see lots of agreements that landlords think are exempt be found not to be exempt because landlords forget to make a disclosure in their advertising or application. Its going to take some time for these things to show up in front of a judge, but smart landlords will be prepared by putting the necessary changes to their applications and advertising in place now so that they can go live with these new rules in June.