New Residential Lease Concepts?

New Residential Lease Concepts?

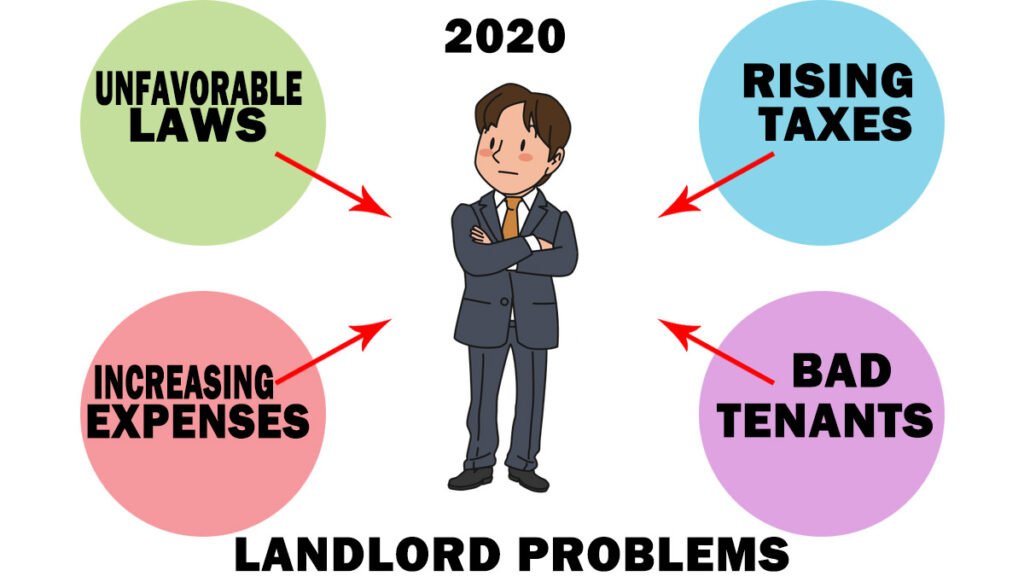

As 2020 begins, Illinois landlords are finding a business landscape that is not hospitable. There are new regulations (Just Housing Amendment) and threats of new regulations (just cause for eviction and rent control). They are facing a looming triennial reasessment by Cook County Assessor Fritz Kaegi who is clearly targeting multi-unit residential properties. They face higher taxes, higher fees, and higher utility charges. What’s to be done?

I was recently reading a column in the Rodgers Park Builders Group newsletter penned by one of my absolute favorite landlord advocates, Verella Osborne of Legal Document Management, Inc. Verella suggested that it might be time for landlords to address the increasing costs of their rental business by passing some of those costs through to the tenant via their lease. She suggested that she knew of two landlords who recently drafted leases that gave the landlord a right to increase the rent during the lease term. This kind of a provision is common in the commercial leasing world and this might be the start of a new trend in the Chicagoland residential market.

One method for cost shifting that landlords might consider is a “base-year tax stop” provision. A base year tax stop can help to limit a landlord’s exposure to property tax increases by passing the increases through to tenants. As a rental property’s real estate taxes increase, the landlord is able to pass the increased tax through to the tenant as “additional rent” rather than the landlord incurring the cost. This payment should be based on those taxes actually paid by the landlord and not based upon the period for which the taxes are assessed.

One method for cost shifting that landlords might consider is a “base-year tax stop” provision. A base year tax stop can help to limit a landlord’s exposure to property tax increases by passing the increases through to tenants. As a rental property’s real estate taxes increase, the landlord is able to pass the increased tax through to the tenant as “additional rent” rather than the landlord incurring the cost. This payment should be based on those taxes actually paid by the landlord and not based upon the period for which the taxes are assessed.

For instance, a landlord might provide in a lease that the rent is calculated based upon the assumption that the tax bill will be $1000 and that the tenant will pay any proportionate share of the increase in the tax bill. Let’s say the tenant begins a one-year lease on January 1, 2020 and the “base” tax bill is $1000. The landlord agrees with the tenant that the rent will be $1500 per month but that the tenant will be responsible for any increase in the tax bill over $1000. The landlord will go ahead and pay the first installment tax bill to Cook County just like always (the bills are out now and due March 1, 2020). That first installment is a “deposit” toward the full year tax bill and is always 55% of the most recent full year bill. However, in late June, Cook County will release the second installment bill. Let’s assume that bill comes out and it is $625. So the tax bill for the property is now $1175. That’s a $175 dollar increase. That bill has to be paid by August 1, 2020. So, beginning with the August 1, 2020 rent and going through the December end of the lease, the tenant will pay $14.58 more every month with the rent because of the increase in the tax bill. That $72 might not break the bank, but if the landlord owns 20 rental units, that’s almost $1500 in the landlord’s pocket that the landlord did not have to absorb. To be somewhat fair, a landlord could build into the formula a “regular” increase – that is, maybe rather than the tenant absorbing all of a tax increase, the tenant would absorb any increase over five or ten percent.

Landlords need to take a good long look at those expenses that might change right under their nose and start to make plans to control those costs. If the cost of heat or other utilities increases, a landlord should consider making the tenant should shoulder some or all of that burden. Perhaps it is time for shorter leases so that cost changes can be better considered without being locked in for a term as long as a year, leases with an option to escalate rent, or leases with built-in rent increases. Sadly, we are in an era where it is politically fashionable to cast landlords in an unfavorable light. The tenant advocacy of the last few years has pushed the case that housing is a human right and that if landlords have to pay extra, so be it. The perception that landlords live off the backs of their tenants and that they don’t actually work but instead sit, like fat cats, collecting rents while ignoring their tenants’ problems is just plain wrong. Most of my landlord clients are ordinary people with jobs, obligations, responsibilities, and mortgages to pay on their own home and on their rental property. I often preach that landlords, especially smaller ones, need to think of their rental property as a rental business and treat it like a business. Maybe it is time that some of the commercial leasing concepts that have been uncommon in the residential leasing world make their debut.

If you are a landlord and are interested in crafting a lease with some innovative positions, be wary of the requirements of local laws, including Section 5-12-140 of the Chicago Residential Landlord and Tenant Ordinance. These concepts might take some time to think through or develop, but the old ways seem to be changing, and for now, with an anti-landlord assessor and an anti-landlord City Council, County Board, and State Legislature, landlords, at least those who are not going to flee Illinois, need to think deeply about how they will tackle the future.